The luxury industry’s ability to cultivate customer loyalty and generate billions in revenue has always intrigued me. And during my years working in retail, I kept an eye on what makes companies like Hermès and LVMH thrive.

Since Q1 2024, the luxury market has been facing a slowdown. And yet, Hermès continued to grow, while LVMH’s financial results showed a decrease.

This unexpected scenario piqued my curiosity. LVMH should outperform Hermès thanks to much higher revenue, broader visibility, and the leadership of Bernard Arnault, one of the richest people in the world, with access to unparalleled resources.

In this newsletter, I’ll explain what made the difference and how we can apply it to the companies we work for.

Two Giants, Two Strategies

Hermès and LVMH are both luxury powerhouses with deep French roots going back to the 19th century. They have grown over the last 20 years, setting trends and influencing the industry’s direction.

But they couldn’t be more different. And I am not talking just about style or product. In my research and analysis, I’ve noticed significant differences in philosophy, execution, and risk tolerance shaping their choices of customer base, distribution channels, and brand strategy.

Before breaking these elements down, let me explain how the luxury market has been changing recently.

The Changes in the Market

The operating environment for luxury has become more challenging, primarily due to what is happening in the Asia-Pacific region, where most luxury customers are based.

Take China, for example—consumer spending is being hit by several challenges: a slow post-COVID reopening, an ongoing property crisis, high government debt, and the Chinese government’s crackdown on its own tech sector. So far, neither the Chinese government nor its Central Bank has done enough to stimulate growth.

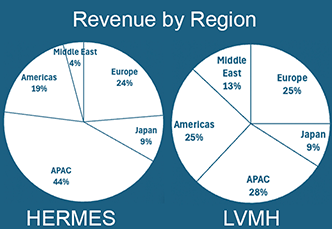

Hermès and LVMH have both depended heavily on the Asia-Pacific region for growth over the past decade. For Hermès, this region accounts for 44% of revenue; for LVMH, it’s 28%—still a sizable share. So it’s no surprise the sector is underperforming, given that China alone represents USD 56 billion (around 15%) of the 369 USD billion global luxury market.

And what do Hermès and LVMH’s financial results for Q1 2025 reveal? Hermès showed 9% growth, while LVMH shrank by 2% year over year for the quarter. The market changes are affecting LVMH much harder than Hermès, for reasons I’ll clarify in this newsletter. Since these financial results were announced, Hermès overtook LVMH’s market cap for a short period, even though LVMH’s overall revenue is much higher.

Another interesting financial fact that I uncovered during my research is Hermès’s price-to-earnings ratio (how much the company is valued compared with its earnings or management’s trading). Hermès’s price-to-earnings ratio was 54X, while Louis Vuitton’s was around 19X. This means Hermès’s earnings are valued much more highly, partly because of how the market perceives their business strategy.

Their unlevered beta (how much their stock price correlates with the economy as a whole or the S&P 500 specifically) can also provide some valuable information. Based on 2024 numbers, while Hermès has a beta of 0.84, Louis Vuitton’s is 1.07. A beta of 1 implies that a stock is closely correlated to the S&P 500 and the broader economy, while a beta closer to zero indicates the opposite. Hermès having a 20% lower beta suggests that their earnings and results are likely to be less sensitive to economic fluctuations.

What sets Hermès apart?

The luxury market knows that Hermès offers something unique and valuable. It’s no surprise that LVMH attempted to acquire Hermès in 2010, leading to an infamous corporate battle that lasted four years and ultimately reinforced Hermès’s independence.

But analyzing their finances wasn’t enough to determine how Hermès was winning. So I took a closer look at their business strategy and found interesting insights regarding their customer segmentation, distribution channels, and branding strategy.

Customer base

To understand why Hermès is winning the luxury race, we must first consider their customer base and the multitude of target markets in the luxury space.

It’s true that LVMH also targets wealthy customers, but not in the same segment as Hermès. Let’s compare, for instance, two of their iconic products and their prices: Louis Vuitton’s Speedy bag (around USD 2,000-2,500) and Hermès’s Birkin bag (around USD 20,000).

As you can tell, the price tag’s difference is impressive. While none of these bags are accessible to the average citizen earning a minimum salary, Louis Vuitton’s Speedy bag can potentially be bought by wannabes, people who aspire to be in the wealthy club. On the other hand, buying a Birkin bag requires the kind of money most people would use to pay off their mortgage.

Hermès has chosen to target the top end of the luxury market, while LVMH aims at what we could call the low end. This strategy allows Hermès to mitigate economic risk by focusing on a less price-sensitive demographic with greater financial stability. In other words, they target a smaller slice of the pie, but a much more resilient one.

Distribution channels

When it comes to distribution channels, Hermès runs a tight ship. They will only sell in Hermès stores. It means they own the channel and the experience, end to end. No discounting, no wholesale, no dilution. They maintain full control over pricing, positioning, and customer relationships. LVMH, however, distributes their products through their own stores but also via channel partners, including major department stores such as Nordstrom in the US.

If I wanted to buy Hermès products where I live in Ohio, I couldn’t. I’d need to drive 285 miles to Detroit, which means 3.5 hours behind the wheel. But I can go to my local Nordstrom and buy LVMH products.

Because LVMH aims at a larger segment with a lower value per unit, their channel strategy must be different from Hermès’s. They need to get their products into these other stores to make them more accessible. But by doing so, they become susceptible to the actions of these outsourced stores.

Hermès doesn’t want to make their products accessible; quite the opposite—a choice aligned with their brand strategy, which I’ll cover next.

Brand strategy

Hermès’s brand strategy masterfully cultivates exclusivity, authenticity, and scarcity, so let’s talk about these elements and how they are interconnected.

Exclusivity

Hermès bets on brand exclusivity, controlling access to its products, especially iconic and high-demand items like the Birkin bag. They deliberately make purchases difficult, prioritizing long-term loyalty over one-time sales.

It’s a powerful statement that people will purchase other Hermès products to have the chance to buy a Birkin—in case you never heard of it, a customer must buy a selection of Hermès’s low-demand items before they can purchase a high-demand one. The goal here is to foster a sense of exclusivity and special status among Birkin bag owners.

I know more than one person who would love to upgrade from Gucci (or other LVMH brand) to Hermès if they could afford it. And the reason is in the word “upgrade”. Owning a Hermès product is seen as proof of significant financial success.

Authenticity

But exclusivity isn’t the only Hermès secret. Today’s customers, especially younger ones, care about how things are made and where they are produced. And this is another win for Hermès, as they emphasize brand authenticity through their nearly 100% French artisanal production and exceptional craftsmanship.

Meanwhile, LVMH’s partial manufacturing in China has sparked backlash on social media, with Chinese manufacturers questioning why consumers shouldn’t buy directly from them if the products are made in the same place.

Scarcity

I’ll also highlight Hermès’s emphasis on brand scarcity accomplished through waiting lists and limited production. Since they don’t feel compelled to meet the demand, they see no need to rush production, a practice that could compromise quality and authenticity. And their customers are willing to wait as it reinforces their perception of exclusivity.

House of brands or branded house?

Hermès is a branded house (one single brand). By having multiple products under one brand, they can concentrate their marketing efforts and maintain a unique, more impactful brand message.

LVMH is a house of brands, targeting multiple segments with different products, such as Louis Vuitton, Hennessy, Gucci, Dior, Givenchy, Tiffany & Co, and Tag Heuer. This model offers flexibility but exposes the company to a wider range of external shifts.

I believe it works better for Hermès to be a branded house, because they want to serve a tiny pool of customers. But LVMH has a bigger market to chase, so it makes sense that they sub-segment and have various messages per brand.

The danger here is that all of Hermès’s eggs are in one basket. If something damages their brand, they have nothing to fall back on. By contrast, if buyers decide to boycott Gucci, for instance, other LVMH brands could potentially sustain overall revenue.

What can we learn from Hermès?

It’s not just one thing that explains Hermès’s resilience. It’s a combination and synergy of factors. They have a well-rounded strategy where each element strengthens the other. And it all starts with the customer.

Whether you’re selling software, clothing, or cars, clarity on who you’re serving—and aligning every decision to that—is what creates resilience. Segmentation drives their decision-making. Branding comes after.

You’d also need to choose what not to do to maintain brand authenticity. If Hermès sold a USD 2.000 bag, they’d sell a lot at first—but their brand would suffer long term. For medium-sized companies, what not to do can also mean saying “no” to certain resellers, platforms, or partnerships if they weaken their positioning.

If I were advising a brand that wants to become “the Hermès of [industry],” I’d suggest they focus on quality, authenticity, product, and learning how a high-end customer perceives these elements.

Key Takeaways:

• Focus beats scale.

• Scarcity builds value.

• Consistency outperforms complexity.

• Authenticity isn’t optional.

• Distribution is a strategic choice.

Is LVMH’s strategy that bad?

Definitely not. LVMH has much higher revenue and, generally, a higher market cap than Hermès–despite Hermès having a strong Q1 2025 and briefly overtaking LVMH’s market cap for a few days. A return to economic growth and certainty would most likely benefit LVMH.

For instance, LVMH grew heavily through mergers and acquisitions. They went out and said that they were going to buy all luxury companies operating in the aspirational to mid-tier segment. They made strategic purchases to corner the market across their segment. And this is a powerful business strategy.

LVMH provides a model for businesses operating across various segments within a broader market. Hermès’s strategy is effective because it’s authentic, but, at the end of the day, they can only speak with one brand identity and to one type of customer. And not every company can choose to renounce other segments.

What comes next?

The luxury market will shift as Gen Z becomes the dominant consumer. For now, most of them can only afford luxury items from the aspirational category. But this scenario will change soon.

Generally speaking, Gen Z values authenticity, social justice, and a hyper-digital life. Luckily for them, Hermès already excels in authenticity. But to compete with LVMH’s strong online presence, they must adapt.

Hermès’s brand identity and products might not need to change, but their messaging and channels will. For instance, if I were marketing Hermès to Gen Z, I’d work hard on showcasing their craftsmanship and ethics on social media.

Hermès has time, but their challenge is having to change slowly to avoid alienating Baby Boomers and Gen X customers. And the risk here is changing too slowly.

From my time in retail, I’ve seen how customer behavior can stay stable for a long period and then change extremely fast. Luxottica, for instance, used to sell glasses through Sears. Back when most people still shopped in person, that worked well. But as buying shifted online, Sears saw less foot traffic, and their Luxottica stores suffered a rapid loss in sales.

And we have yet to see the impact of Trump’s tariffs on the luxury market. Depending on how firms respond to the tariffs and whether the predictions of a global slowdown will come true, Hermès is likely to be less impacted compared with LVMH. But only time will tell.

Closing Thoughts

Luxury isn’t about price tags. Hermès isn’t winning because it’s more expensive. But because it’s focused and deliberate. They’re all about strategy alignment and brand discipline.

Hermès and LVMH offer two compelling templates—both valid, but not interchangeable. They show us that there is no single path to success.

Ultimately, the takeaway isn’t to copy either, but to ask: are we clear about who we serve, what we stand for, and how we go to market? The companies that answer that well, like Hermès, tend to endure uncertain times.