If you’ve been following the headlines, you’ll know that Philz Coffee, a brand linked to slow-poured cups and premium beans, was recently sold to Freeman Spogli & Co. for roughly US$145 million.

On the surface, that might sound like a decent exit. But the consequences of the deal for employees who invested in the company’s stock are raising some eyebrows.

In this article, I’ll walk you through Philz Coffee’s journey and tell you how the mechanics of venture capital led many employees to buy into a dream only to watch it dissolve into nothing.

A Family and a Brand

Phil Jaber opened the first Philz Coffee in 2003 in Silicon Valley. It started as one store with a very clear proposition: a high-quality, slow, urban, personal coffee experience.

In case you don’t know them well, Philz Coffee is more of a Blue Bottle competitor than a Starbucks clone. Philz’s drinks cost about 60% more than Starbucks equivalents (US$7.95 for a 16 oz cold brew vs. US$4.95 at Starbucks). To justify the extra cost, they roast their own beans in Oakland, California, and lean into the handcrafted cup narrative.

Phil ran the original shop until his son, Jacob Jaber, joined and spearheaded expansion in 2005. Under Jacob’s leadership, Philz Coffee went from a single store to 75 locations across California, Chicago, and the DMV area (D.C., Maryland, Virginia) by about 2022.

Positioning Philz as the top tier of coffee chains worked for over 15 years. But scaling a high-end concept is tricky, especially when the financing behind that growth is venture capital.

Venture Capital and Funding Rounds

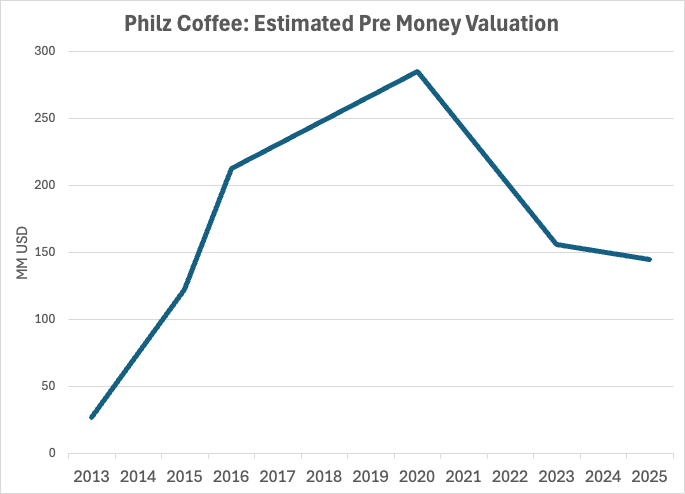

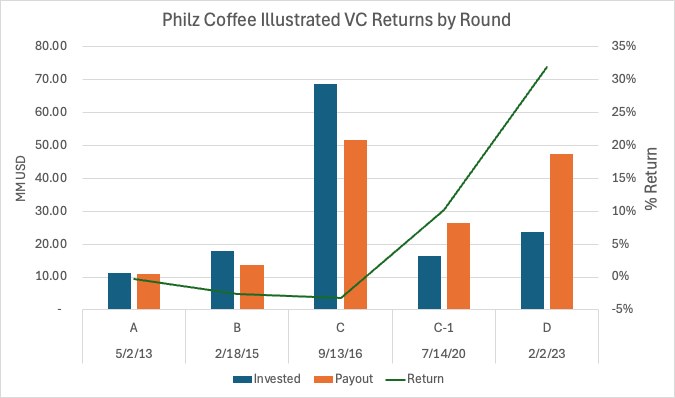

While there isn’t much public information available about their expansion, Philz Coffee likely raised around US$137 million through five rounds of financing from 2013 to 2023. Over the years, many venture capitalists bet on their business, such as TPG, Summit Partners, Divide by Zero, Conglomerate, and Uncorrelated Ventures.

Here’s how venture funding works: each round comes with goals, often related to opening more stores, expanding into new markets, and increasing profitability. If you hit the goals, your valuation goes up, and the next round raises more money at a higher price. Miss them, and you risk a down round, where valuation drops and investors tighten terms.

In this scenario, the venture capitalists position themselves to take part in the upside and to limit their risk on the downside. On the upside, they benefit from investing in both preferred stock and common stock (which is often more lucrative). On the downside, they limit their risk by being first in line to recover their money before common stockholders. This approach is a way to balance out the extremely high risks that come with investing in startups.

In Philz’s case, the early rounds were focused on expanding from Silicon Valley to nearby cities. Later rounds expanded the company’s presence into major markets like Los Angeles, Chicago, and the DMV area.

Everything was going so well that Philz Coffee created an employee stock program. Jacob offered all staff the chance to buy common stock and participate in the wealth Philz was building.

It sounded like a great idea, considering how well the company was apparently doing. But it all ended when Philz Coffee stopped hitting the targets they had planned and agreed upon with the venture capitalists.

COVID Shift and Decline

By 2020, Philz Coffee had reached their fourth funding round, with valuations climbing and expansion in full swing. But then the pandemic hit.

Initially, there was a surge. People stuck at home were willing to spend on little luxuries like US$15 cups of coffee. That spike, however, proved short-lived. Once restrictions were lifted, the market shifted hard. Consumers wanted to spend on travel, dining out, and experiences, not expensive coffee on the way to work. That’s if they were going to the offices at all, as many people kept working remotely.

Philz’s fifth funding round (2023) reflected the change. The pre-money valuation was almost half of what it had been in 2020. And instead of opening new stores, they closed five, mostly in the DMV area. Two big red flags for investors.

It’s also worth noting that this down round was probably implemented to provide a financial lifeline while an exit strategy was engineered. And in doing so, the venture capitalists set themselves up to make a significant return on the downside instead of taking a larger participation in an upside exit.

The Sale to Freeman Spogli & Co.

Now we arrive at 2025, when it became clear that Philz wasn’t about to make a triumphant IPO. Instead, the family sold the business to Freeman Spogli & Co. for about $145 million.

But they owed around US$140 million to venture capitalists. And during the exit, they were expected to follow the same preference rules observed in liquidation or bankruptcy proceedings. The venture capitalists got paid first, from the most recent until the earlier rounds. Some investors might have doubled their money. Early-stage backers broke even or took a small loss.

Common stockholders were last in the payout order. And after the preferred shareholders were done, it’s believed that there wasn’t a penny left. It was also stated in the agreement with Freeman Spogli & Co. that common stocks should be canceled.

As a result, the employees who had joined the stock program got nothing.

How Exit Preferences Work

This is the part I wish every person understood before buying into an employer stock program, especially if said employer has been funded by venture capitalists.

As I mentioned, when a company funded by venture capitalists sells the business, it must follow the same preferences expected from a liquidation or bankruptcy process. Unless the existing investors (preferred shareholders) collectively agree to make a different distribution. That’s very rare.

Meaning that the money from the sale must be distributed in a set order:

1. Government (taxes).

2. Employee wages (back pay).

3. Debt holders (banks, bondholders).

4. Preferred shareholders (often venture capitalists).

5. Common shareholders (early investors, employees).

If Philz Coffee had performed or outperformed their goals, they would have had more cash in the exit, some of which would have gone to the common stockholders. The venture capitalists also could have received a larger payout in this scenario.

Unfortunately, Philz’s employees and their common stocks were in that fifth bucket with no money left in it. Given the payout rules, it’s easy to see why they never had a chance.

What Philz Coffee Could Have Done

Post-pandemic, Philz Coffee has been in a truly difficult situation. Consumer habits have changed deeply. Blue Bottle, their direct competitor, is also closing stores.

Philz Coffee’s logical response could have been to go downmarket into the upper end of mid-tier coffee, but that puts them firmly in Starbucks’s territory. And Starbucks has been pushing themselves to present a more upscale image, so there isn’t a lot of space for Philz.

They could also have changed or evolved their concept, for instance, to a higher-end convenience store. This move would demand a fresh concept under a separately financed company, but potentially, it could have helped them recover some of their losses.

The Employee Perspective

Many Philz employees put in thousands—sometimes their life savings—into the stock program. It was a high-stakes bet on a business that, while beloved by many, was risky and vulnerable to market shifts.

And common stocks linked to venture capital are an opaque and risky investment. This is one reason the SEC has generally maintained that only accredited investors can play in venture capital. But Philz Coffee’s employees didn’t seem to have been fully informed of the risks.

Once the struggle the company was going through became clear, the next question would be whether the employees could have sold their shares either before or after the exit. And the answer is no in both cases.

Selling before the sale was theoretically possible through secondary markets like Forge or Linqto, but costly and uncommon, considering it has to be facilitated by a niche player. An employee might have been able to get out, but it would have been expensive to do so. And what price they would receive is hard to say. It would depend on the view of potential buyers regarding Philz Coffee’s prospects at the time.

On top of that, common stock plans usually have tenure requirements, and they’re not traded on a public market, making it hard to divest an investment. In practice, most employees were on the train until the end.

After the acquisition, Freeman Spogli canceled all open stock options and bought all available stock as part of the transaction. There was no way out for the employees.

Thankfully, Philz Coffee’s scenario is unusual. But it doesn’t make it less concerning. If this had been a public company stock program, the employees could have sold at any time. But Philz Coffee is a private company, and private shares are traded differently.

Still, it’s important to distinguish what happened to Philz Coffee from other situations, such as:

· OpenAI’s recent plan to allow employees to cash out their stocks is a different scenario. If it comes to pass, the employees will have access to an exit plan provided and secured by the company.

· When companies offer free stocks as part of a compensation plan, the employees aren’t putting their own money into it. So, there’s no downside risk unless the stocks are replacing a defined salary.

Lessons Learned

Looking back, I think Jacob offered the stock program with the best intentions. He believed in the company and wanted employees to share in its success. But the problem is that most people aren’t versed in venture capital mechanics. They don’t know about exit preferences or how often companies fail.

So here are some takeaways I’d like you to remember:

· Concentrated risk is dangerous: If your paycheck and your investment both depend on the same company and the company fails, you could lose both your income and savings overnight.

I’ve been offered stock from employers before and turned it down, not because I didn’t believe in the company, but because I didn’t want to tie up my financial future in one basket. It’s a lot of concentrated risk.

· Know your place in the payout line: Common shareholders are last during an exit, bankruptcy, or liquidation. If there’s debt and preferred stock ahead of you, there may be nothing left for you. This isn’t a fraudulent scheme; it’s simply how the financial distribution model works in these cases.

· Liquidity matters: Public shares can be sold. Private shares often can’t—at least not easily or cheaply—especially if there is tenure or other restrictions listed in the employee stock program.

· Ask hard questions: Before you invest in your employer, understand the company’s financials, growth trajectory, and capital structure.

Finally, and most importantly, if you are leading a team that has just been offered company stock, be honest with them and make the facts clear. Let them know that, yes, they might make a lot of money, but they also might lose everything. By doing so, similar devastating losses, like the ones suffered by Philz Coffee’s employees, can be avoided.